2024 Shale Insight Conference:

Perspectives on the new EU Methane Regulation for Global Energy Importers

Published: October 30, 2024

Revised: January 24, 2025

By: Elizabeth McGurk

Montrose recently hosted a technical panel session at the 2024 Shale Insight Conference, which I was pleased to moderate, focusing on the impacts of the new European Union Methane Regulation (EUMR) for global energy importers. Although this panel focused on the Liquified Natural Gas (LNG) supply chain, the EUMR regulates natural gas, oil, and coal importers in all EU member countries.

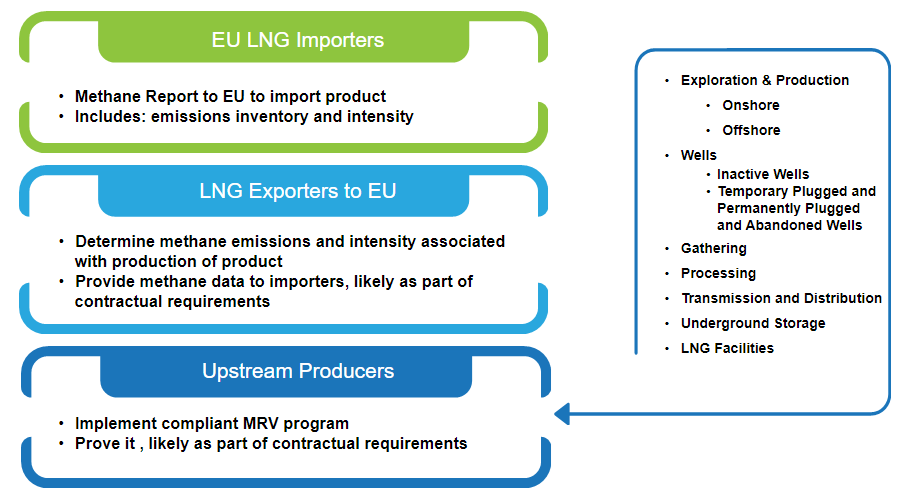

The discussion focused on the regulation’s upstream emissions reporting and intensity requirements, posing significant supply chain implications for global energy production and prompting European importers to prepare for a future of operating in a global regulatory environment.

To put this in perspective, in 2022 almost 65% of LNG produced in the United States (US) was Europe-bound, making the EUMR extremely impactful to operators throughout the US. Moving forward, we can expect an even greater percentage of US natural gas to be imported by global markets if and when new US LNG facilities are authorized. It’s clear that the EUMR is going to have a far-reaching impact, not just in Europe, but across the global energy landscape.

The regulation, finalized in August 2024, represents a new benchmark for methane emissions standards, building upon existing Monitoring, Reporting, and Verification (MRV) frameworks and adding accreditation verification requirements and public transparency. The EUMR is taking measurement requirements to new heights, mandating MRV throughout the entire energy production supply chain.

The EUMR: A New Global Standard for Methane Emissions

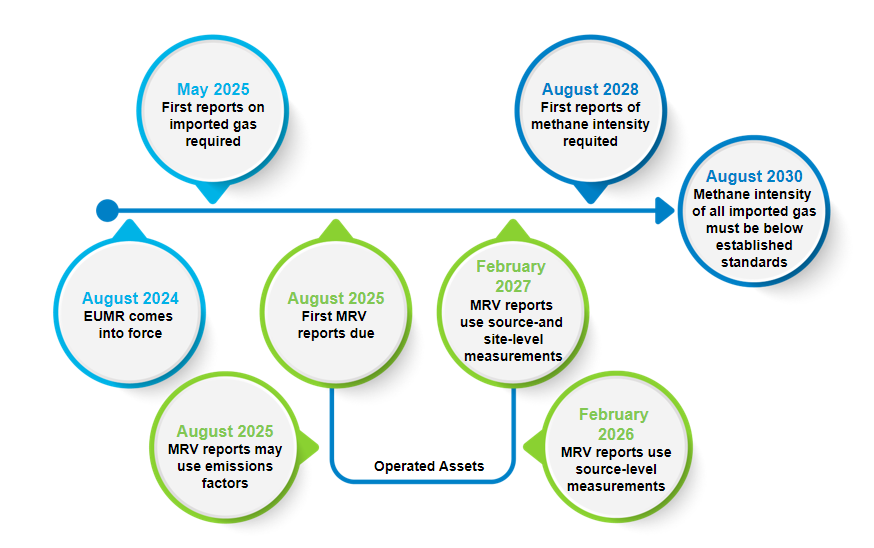

At its core, the EUMR is an MRV-based framework. It requires compliance with Leak Detection and Repair (LDAR) requirements, limits on venting and flaring, source- and site-level reconciliation expectations, verification, and transparency in reporting both total associated emissions and upstream emissions intensity. The EUMR requirements go beyond compliance for regulatory compliance’s sake and instead require buyer transparency for governments and the public to analyze how well energy operators are managing their methane emissions. The requirements will be phased, but the first report will be required in mid-2025.

Two points that are particularly notable: (1) These requirements will start to hit soon, and (2) the regulation is comprehensive and encompasses the supply chain, from production through point of .

Global Implications: More Than Just a European Issue

A key point made during the discussion was the global reach of the EUMR. Although it is directly tied to European operations and imports, its influence is expected to extend far beyond EU borders as the EU imports much of its energy. The regulation supports Europe’s commitment to the Global Methane Pledge, which aims for a 30% reduction in methane emissions by 2030. Global upstream sectors like exploration, production, and LNG transport will feel the impact as part of the contract supply chain. Operators in all industry segments should expect to see MRV and emissions intensity reporting requirements incorporated into their sales contracts soon.

Several panel members noted how methane’s influence on climate change is pushing the global regulatory needle and is anticipated to spark similar initiatives worldwide. If you are a company operating outside of Europe, you need to monitor this regulation closely, because it could be a blueprint for what’s to come in other major energy markets. Specifically, we expect to see similar requirements implemented in the Asian market soon.

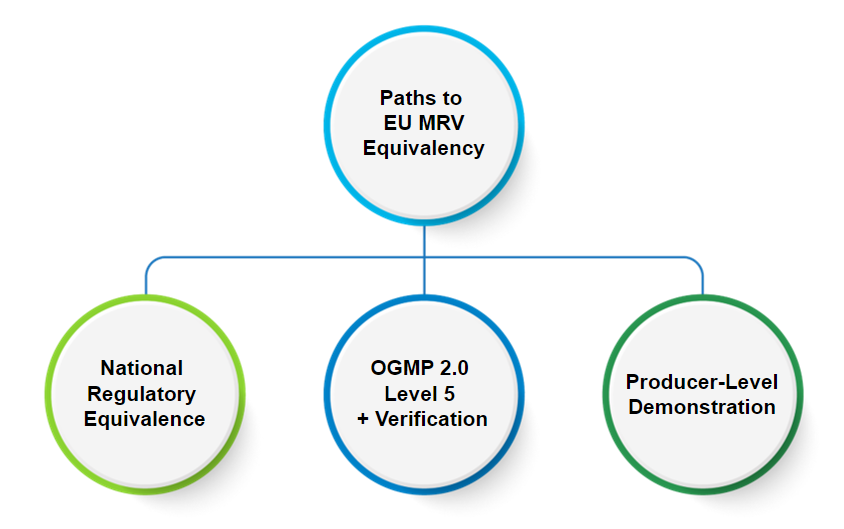

Navigating the EUMR: Three Compliance Pathways

The EU Commission is expected to release more details on calculation methodologies and verification requirements. Current guidance indicates three pathways to EUMR compliance: national regulatory equivalence, adopting the OGMP 2.0 Gold Standard with the addition of independent verification, and producer-level demonstration.

Dr. Lara Owens, Director of Science and Technology at MiQ, an independent third-party verification provider for methane emissions benchmarking, spoke of MiQ’s collaboration and work with the EU Commission in developing the EUMR and highlighted how effectively many US operators are already managing their methane emissions.

Lauren Sion, Senior Consultant, Sustainability and Climate Advisory, at Montrose Environmental highlighted the synergies between the EUMR, OGMP 2.0, and existing US regulations, and emphasized that an integrated approach to methane management will benefit operators on both sides of the Atlantic.

Regardless of the pathway chosen, companies will need robust MRV systems to ensure accurate site- and source-level measurements and defensible data management and disclosure processes. The phased reporting timeline from 2025 to 2030 will ease companies into full compliance, giving operators some breathing room to implement necessary technologies and processes. But even with that flexibility, the consensus is that companies need to act now. Robust MRV programs take time to effectively implement; waiting until the last minute is not a viable option.

Global Regulatory Dynamics: The EUMR vs. US Approaches

It is important to note that we are not aware of any country having demonstrated national regulatory equivalence at this point, as national regulations do not include all components of the EUMR. For instance, although the US has seen many changes to methane regulations this year, the US EPA has not included requirements for either verification or site-level reconciliation, which are both EUMR requirements.

One of the most interesting parts of our panel discussion was the comparison between the EU and US approaches to methane regulation. The EUMR is very prescriptive, leaving little room for interpretation, while US regulations tend to focus more on compliance reporting, incentives, and collaboration between regulators and industry players. Both approaches have their merits; the EU’s model is driving immediate and prescriptive action, while the US is focused on rewarding innovation and collaboration. In either case, technology and data management are going to be crucial for success. The US market will also have unique challenges in complying with the EUMR because of the unique nature of our value chain. The US operates in a pooled marketplace where natural gas from multiple locations and producers is often combined prior to reaching a LNG liquefaction facility. Data management and integrated methane management programs will be critical for success.

Walt Hufford, Director of North American Government and Regulatory Affairs for Repsol raised concerns about gaps in the EU’s rules and warned of potential complications that could result from each member country establishing their own rules. He also expressed concerns that some operators, especially small ones, will have in meeting these new requirements.

Risks and Opportunities in Methane Regulations

As with any major regulations, there are both risks and opportunities. The lack of standardization in methane reporting was highlighted as a significant risk. Different countries and regions will have their own sets of rules, and for global operators, that could lead to a lack of clarity on how to comply. Unclear regulations could expose companies to penalties and legal liabilities.

Todd Normane, former Senior Vice President, Chief Sustainability Officer at Equitrans Midstream and now President of TLN Sustainable Solutions, likened these methane regulations to financial reporting, stressing that companies will need the same level of rigor in managing their environmental data as they do in managing their financial data.

The opportunities with enhanced methane tracking and standardized reporting also bring significant benefits. Aligning with global methane regulations could offer a competitive edge for companies that are proactive in adopting these standards. Early investment in methane reduction technologies and better reporting systems will strengthen their market positioning. This is not just about staying compliant—it’s about market forces driving scrutiny and change in how energy is produced and sold.

The Future of Methane Compliance

By the end of our panel discussion, it was clear that the EUMR’s reach will be broad. Many, if not all operators, should see themselves as global suppliers and will need to look ahead at integrating advanced methane monitoring technologies, developing durable and transparent data management systems, and identifying preferred third-party verification programs.

Collaboration, transparency, and innovation are going to be the driving forces behind future methane compliance, energy economics, and supply chain transactions. The EUMR is shaping the future of methane management, and companies that prepare now will be better positioned not only for compliance, but also to lead the charge in a climate-conscious energy market.

Prepare for the Future of Methane Regulations Today

The path forward for methane compliance is both challenging and full of opportunity. Montrose is here to help you navigate this transition. With our comprehensive methane solutions, we can support your compliance efforts and drive meaningful change. Reach out to our team today to discuss how we can help you stay ahead of the curve in methane management and compliance.

Elizabeth McGurk,

Elizabeth McGurk,

Managing Consultant, Climate and Sustainability Advisory

Elizabeth is a highly-experienced air quality program manager with expertise in the fields of greenhouse gas (GHG) quantification and mitigation, oil and gas sustainability framework implementation, regulatory analysis, and auditing. Her passion is in leveraging measurement-informed data to inform effective mitigation efforts, and she is proud to have supported OGMP 2.0 projects worldwide. Elizabeth has a strong background in delivering technical trainings and excels in distilling and presenting complex information, impacts, and solutions to various stakeholders. She leads diverse teams and has conducted complex environmental projects, both regulatorily and voluntarily driven, for clients in carbon-intensive industries. She specializes in assisting clients with Scope 1, Scope 2, and Scope 3 GHG emissions quantification and reporting as well as in developing practical, real-world carbon reduction strategies.